Quickbooks Owners Draw, Web owner’s draw in quickbooks:

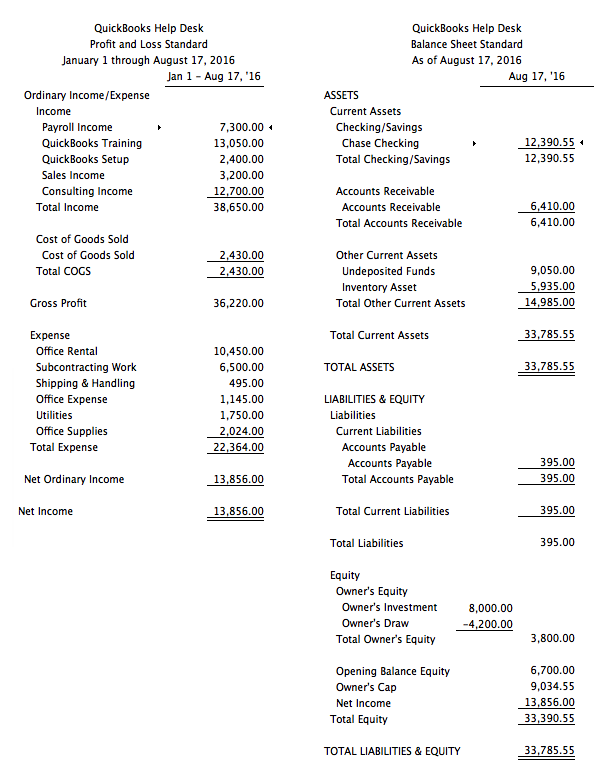

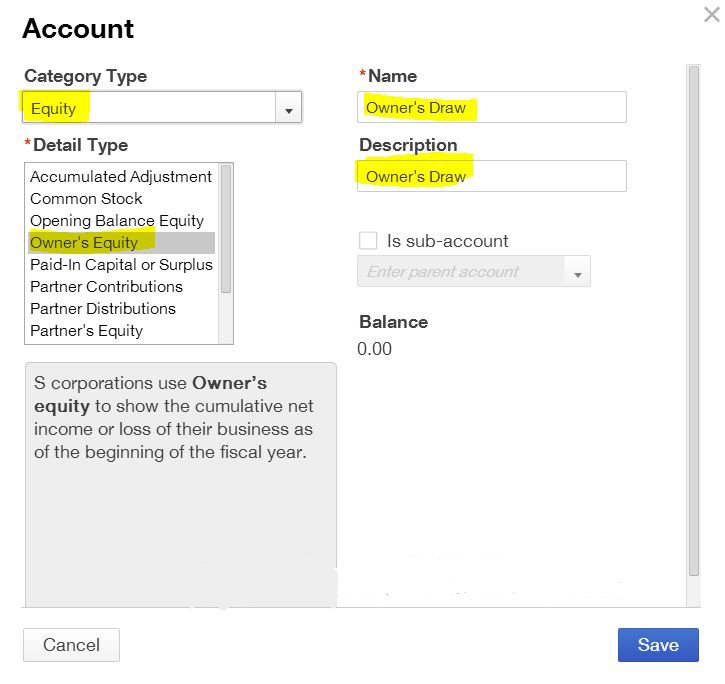

Quickbooks Owners Draw - If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web learn how to pay an owner of a sole proprietor business in quickbooks online. Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. Also, you cannot deduct the. Web an owner's draw is money taken out of a business for personal use. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. However, owners can’t simply draw as much as they want; Web learn how to automate tasks and keep your books organized going into tax time. Published on 26 sep 2017. It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web am i entering owner's draw correctly? Then at the end of each year you should make a. However, owners can’t simply draw as much as they want; This transaction impacts the owner’s equity. Most types of businesses permit draws, but you should consider whether and when to take one. This guide will walk you through what. This transaction impacts the owner’s equity. This article describes how to. If you work as a sole proprietor, your compensation would typically come as an. This guide will walk you through what. This leads to a reduction in your total share in the business. Web am i entering owner's draw correctly? Web the owner's draws are usually taken from your owner's equity account. Quickbooks online is a leader in accounting software, thanks to its strong feature set, scalability and ability to accommodate small businesses with. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. The owner's equity is made up of different funds, including money you've invested in your. Web learn how. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. Web to properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal and maintain accurate financial records. Published on 26 sep 2017. Web. Published on 26 sep 2017. Also, you cannot deduct the. Web learn how to pay an owner of a sole proprietor business in quickbooks online. However, owners can’t simply draw as much as they want; Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited. The draw acct should be zeroed out to owners capital (sole pro.) or retained earnings (corp) at the end of each accounting. Web the owner’s draw is the distribution of funds from your equity account. This will handle and track the withdrawals of the company's. When the owner of a business takes money out of the business bank account to. The owner's equity is made up of different funds, including money you've invested in your. This will handle and track the withdrawals of the company's. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. This leads to a reduction in your total share in the business. Web to pay back your account using. This guide will walk you through what. The owner's equity is made up of different funds, including money you've invested in your. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Web the owner’s draw is the distribution of funds from your equity account. This transaction impacts the owner’s equity. This article describes how to. However, owners can’t simply draw as much as they want; Web an owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures, the money is treated as a draw on the owner's equity in the business. Web the owner's draws are usually taken from your owner's equity account. Quickbooks online is a leader in accounting software, thanks to its strong feature set, scalability and ability to accommodate small businesses with more. Web to properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal and maintain accurate financial records. This guide will walk you through what. Web learn how to automate tasks and keep your books organized going into tax time. Web am i entering owner's draw correctly? Web to pay back your account using an owner's draw in quickbooks, follow these steps: Web when making a direct deposit payment to an owner, you'll need to set up an owner or partner as a vendor, as suggested by my colleagues above. Web in quickbooks desktop, properly setting up and recording owner’s draws ensures accurate financial tracking and reporting. Pay for business expenses with personal. Also, you cannot deduct the. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

how to take an owner's draw in quickbooks Masako Arndt

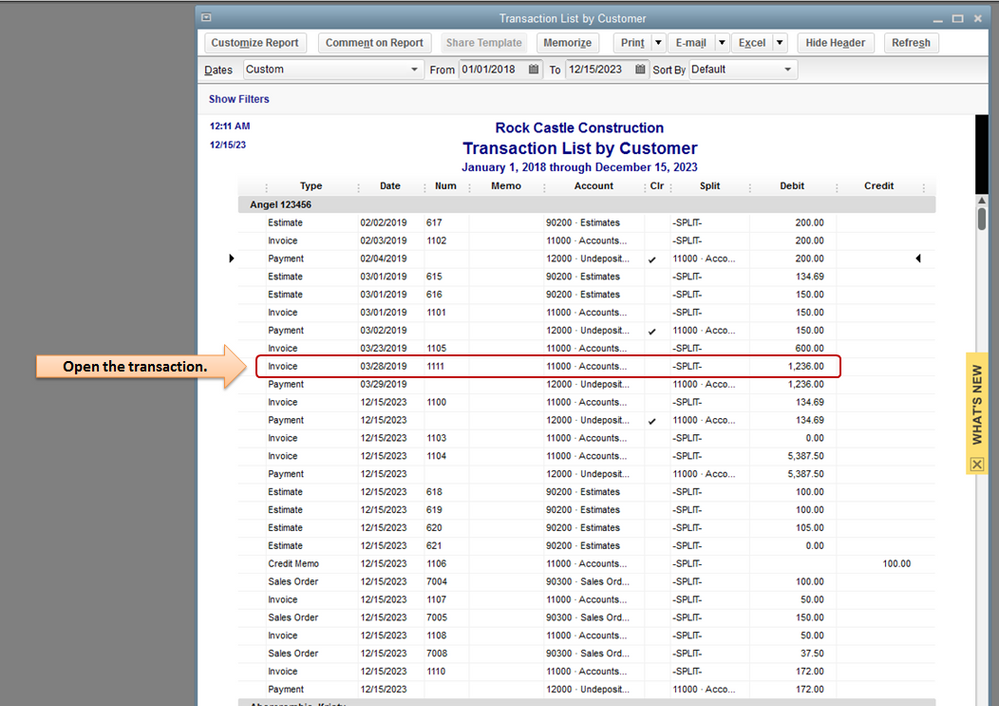

Owner Draw Report Quickbooks

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Owners draw QuickBooks Desktop Setup, Record & Pay Online

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owners Draw Quickbooks Desktop DRAWING IDEAS

Web The Owner’s Draw Is The Distribution Of Funds From Your Equity Account.

It Is Necessary To Make A Record For The Transactions Of The Owner’s Withdrawal For The Financial Reasons Of The Company.

If You Work As A Sole Proprietor, Your Compensation Would Typically Come As An.

Web Owner’s Draw In Quickbooks:

Related Post: